To fire back up my writing, I wanted to foray into Fintech for the first time. Some great young writers like Clément or Alex inspired me to get out of the comfort zone here, kudos to them.

I recently fell down two rabbit holes simultaneously: one of them is SPACs, the other is Chamath Palihapitiya’s exceptional thinking on value investing.

Social Capital’s just recently announced it would sponsor three more companies to go public through SPACs, and one of them is SoFi.

SoFi was born in 2011, founded by four Stanford students trying to solve classmate’s and their own problem: student loans. The company’s first product was a peer-to-peer loan program funded by 40 alumni who would turn into $20k loans for 100 students. The proprietary model for qualifying customers’ credit and frictionless experience quickly got SoFi well-funded, both in equity and in credit lines to hand out debt.

After successful funding rounds, the company pulled through a rough patch between mid-2017 and late 2019:

In September 2017, CEO and co-founder Mike Cagney announced that he would resign by the end of the year due to allegations of sexual harassment and was replaced by Anthony Noto (former COO of Twitter) who still leads the company today.

In June 2017, vanilla lenders across the US leveraged the Cagney scandal to rally against giving SoFi a bank charter, which would have considerably accelerated its operations

Throughout 2017, persistent rumors about a sale were floated by financial news pundits, touting a $7-9bn price tag. Thankfully, any of them failed to materialize

In October 2018, SoFI settled charges with the federal government (FTC, specifically) on making baseless claims about how much you could save refinancing student loans

After experiencing two hectic years, SoFi secured a $500m investment from Qatar Investment Authority, and started using the fresh money to aggressively change strategy.

It pioneered a holistic approach that has now become a playbook for many Fintech start-ups : cater to a burning need - refinancing and paying off student loans faster -, then expand into a super-app for all things money.

There is an all-out race to follow this playbook. All major players know consumer technology plays are “winner takes most” plays.

The question is: how do you build such a holistic product without getting lost ?

Part of the answer lies in obsessively up-selling and cross-selling the existing user into more opportunities to manage their money in a clever way.

In Fintech super-apps, the equation looks simple on paper: the product has to gradually absorb all needs starting from your initial use case, chaining those in an elegant way to drive up switching costs for the user.

A large breadth of consumer Fintech suffers from lack of upside by diversification. Many products are interoperable but can’t scale themselves to be a super-app, which results in capital-intensive user acquisition and limited moats down the line.

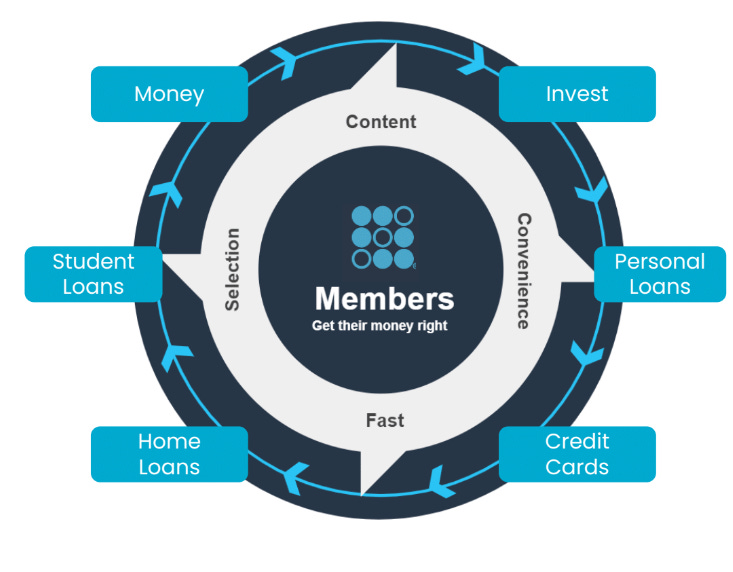

To tackle this, Sofi has built a flywheel of its own called the FSPL or Financial Services Productivity Loop. The loop is pretty simple:

Customers start by using SoFi Money for a consolidated view of their balances and spending

Then they continue by tracking and optimizing their credit score using Sofi Relay

Then they start investing aided by a robo-advisor in retirement funds, riskier ETFs, stocks and even try and buy some cryptocurrencies

Then they turn to SoFi for personal loans like student loans, home loans and in-school loans

And eventually when it has delivered the “get your money right” promise, it rewards customers to spend via a proprietary credit card

A defining factor of SoFi’s future is its velocity. All of those products and features were added to the platform in a little under two years between January 2019 and the end of this year. This is a very short timeline when compared to other players like Revolut, Monzo, etc.

Achieving such a timeline was important to get the flywheel going :

Member growth finally unlocked - From low single digit member quarter to quarter member growth in 2019 (c.+8%) to +75% this quarter, on track to achieve an equivalent yearly growth in 2021.

Cross-buy jumped - As the full suite rolled out this year, the feedback was immediate in terms of cross and up-selling SoFi products and multi-product users were up +95%

SoFi is a great example of driving unit economics by horizontal integration and is based on the following principle: I’d rather acquire users cheap for a simple money management product than spend 20 times the amount to sell them a personal loan.

In other words: if you can design a journey to naturally upsell a significant portion of your users (>50%) into high-margin products, you can generate 30 dollars from every marketing dollar spent.

The great news is that the synergy works best in cross-selling high-value, low frequency products such as home loans:

There has been a lot of movement in Fintech infrastructure - including the much discussed acquisition of Plaid by Visa, announced a year ago and called off three days ago by the U.S. Department of Justice.

The name of the game for all players is pretty simple: create and monopolize the infrastructure layer for FinTech and become the AWS for this space. Why ? Once critical mass is obtained, you scale and profit handsomely from a rent that’s attached to the growth of the overall market. It’s both a clever growth initiative and a handy hedge for your other, riskier bets. It goes to show, in my view, that CEOs are also super risk-allocators.

In April, SoFi made a hefty acquisition as well and bought infrastructure player Galileo for $1.2bn in cash & SoFi stock. Both companies had an existing relationship, SoFi has been a client of Galileo for a long time and watched many of its competitors (Robinhood, Revolut, Chime, Monzo, TransferWise) become clients as well. Through its infrastructure API providing back-end for checking and savings fintech products, Galileo (50m managed accounts) has a 30x bigger surface area than SoFi (1.7m accounts).

By 2025, Galileo’s backbone is expected to generate revenues topping $900 million, up from only $103 million in 2020. The market will highly value a company with a bigger focus on the tech portion of fintech.

There is several things to consider to understand the move:

Synergies for lower cost at scale. This one is the most obvious: SoFi gets access to all the technology it needs to finish rolling out its offering, and reaps the benefits at scale. It’s yet another step in the full-stack tech strategy that SoFi has pursued since its “relaunch” in 2019

Additional distribution, both ways. By gaining access to Galileo’s customers, SoFi is able to provide (i) white-labeled financial services from their own rooster (ii) lead generation opportunities for smaller companies through their comparator, Lantern

Revenue diversification hedge. SoFi’s management expects the tech platform to make up a quarter of total revenue by 2025, providing a nice hedge to lending activities. In my opinion, lending growth may slow down if SoFi fails to keep their loop spinning or faces increased competitive pressure from full-stack players. Integrating vertically with a bigger surface area provides a hedge

Did SoFi make a much better deal that Visa couldn’t with Plaid ? It’s definitely arguable that (a) the EV/Sales multiples paid probably isn’t at a premium to where $IPOE is currently trading at (aprox. 12x vs. 13x) and (b) it also bought an asset with far greater complementarity, both in terms of footprint and growth synergies.

It clearly couldn’t be suspected to be the deadly hug I think Visa tried to give to Plaid by swallowing it, and will prove to be an excellent hedge and cash machine looking at a 10, 15-year outlook. Galileo’s stable, predictable growth and cashflow can be a hedge and anchor for SoFi’s riskier bets on the core product - Which it will 100% have to make considering the incredible competitive pressure in the space.

That one is a little counterintuitive, but I actually think that Visa dropping the deal can be a challenge to SoFi in the mid-to-long term view.

Here’s a quick round-up of the events for context:

In January 2020, Visa announced that it would be acquiring Galileo challenger and Fintech API company Plaid for $5.3bn

In November, the US Department of Justice sued Visa to block the deal amidst anti-trust concerns, arguing that Visa was preemptively absorbing a future competitor

Visa finally threw in the towel three days ago and put out a press release stating that it wouldn’t pursue the deal

In my view, Visa dropping the Plaid deal in the middle of nowhere maintains competitive pressure on Galileo. I think Visa was trying to hug Plaid so hard it would choke and they would remain hands-free to create their own Fintech API.

Plaid’s last financing round was a $250m Series C in 2018. While none of us mortals know how much runway is left after the protracted uncertainty around the acquisition, it’s possible that Plaid is very much in a position to (a) be acquired by another player, mimicking SoFi’s move with Galileo or (b) raise another jumbo round and consolidate position.

That being said, two bottlenecks to this bear argument:

Galileo’s footprint in the US is second to none. Practically speaking, 90% of neobank account creation traffic goes through their infrastructure. Even if Plaid is well funded, the B2C territory is Galileo’s preserve - Although, there seems to be some overlap between different providers if you look at logos !

The expected proceeds from SoFi’s SPAC far outweigh any possible amount Plaid could reasonably raise in the coming months. If the deal was to happen right now, trading at $19.2 apiece, the deal would top off a $16.6bn valuation and bump up the proceeds - which, even at the initial $10 price, were going to net $800m for the company anyway. It’s hard to conceive Plaid could raise that much in a relatively short time frame

The takeaway here is that SoFi is an appealing investment once the business combination with the SPAC put forth by Chamath Palihapitiya closes in a few months. For now, the stock appears to be kind of overvalued, trading well over 13 times its sales target for 2021.

With the volatility that occurs with most SPACs heading into the closing date, you could look to Buy IPOE on weakness and averaging their cost over the next few months. In my opinion, SoFi has a compelling business model with accelerating revenue growth thanks to the clever infra play, but a better value is likely to occur down the road, when the price starts teetering a little.

PS and disclaimer: This is obviously not investment advice and my opinions are mine alone and do not reflect that of my employer.

If you came thus far, thank you so much for reading this post, I hope you enjoyed it. Don’t forget to go pay a like and subscribe on Twitter. 🐦 You can always hit reply and let me know with your thoughts via e-mail ! 🤗