Hi ! Ulysse here. Welcome to another issue of The Rookie VC. This week I wanted to talk about a company I have long been lurking around : Public.com - Yet another occasion to fixate my thoughts around a specific topic.

Public’s mission is fairly universal and is not going away: it is here to make investing in the stock market a fun and social experience. We’ll go over what I think competitors don’t get right and how this makes the product pretty unique. In terms of experience, it’s two notches above any consumer product for democratizing investing.

I’ve always referred to Public as a nice thrupple (trouple) between an app that reduces the friction for investing in the stock market (Robinhood), an easy-to-use discovery space (Pinterest) and a vibrant community of curious finance writers (Seeking Alpha). Although not perfect, it’s a well balanced combination of all three aspects.

And quite honestly, I’m writing about this company in hopes of understanding why no such product exists in Europe just yet and what would be the roadblocks to remove. And hopefully get noticed by someone building this in his room or a garage somewhere in France (!)

Let’s step back and look at the broader trends that encourage the democratization of investing and the rise of a company like Public.com:

The rise of fractional investment

Fractional investing is simply acquiring tinier bits of a stock from a broker, which allows you to invest much smaller amounts of your savings into the stock market

Robinhood and bigger, more established brokers such as Charles Schwabb pioneered by offering their clients the possibility to sign up for a brokerage account on their smartphone and directly start trading fractions of any given stock

The broader “fraction economy” theme

Over the years, we have witnessed a strong democratization of the access to certain financial products, allowing to modestly bridge up some inequalities by helping individuals get started with their financial literacy

The rise of products and companies tackling the increased need for bits of assets is directly linked to the overwhelming supply of money poured into our economy by central banks handling major currencies - In other words, rampant inflation of asset prices justifies the emergence of fractional investing

Unbundling Reddit

Focusing back on the discovery and media aspect of Public’s product, I think that one of the strong underlying trends is the progressive unbundling of Reddit as a discovery channel (for more on the topic, check out this great Substack by Greg Isenberg)

Subreddits are not proteiform in terms of feature richness. Therefore, they eventually can’t cover their ground under a specific topic and offer the right discovery and social features for every single subject. Therefore, an opportunity and a playbook emerged over time for startups

While r/wallstreetbets is a fun bunch and is mostly a consumer daytrading community, there is also much more serious and “prosumer”-oriented products and communities. From my (short lived) career in banking, I remember spending hours on Seeking Alpha looking at transcripts or analysis by community writers, or reading threads of discussion. But this was a very different crowd compared to most finance & investing subreddits I had looked at in the past

The convergence of pop culture and investing

Until recently, I thought that “finmeme” (finance-related memes) were only a microcommuntary thing and that I had an obivous bias as an ex investment banker and finance adept at finding that investing, finance and pop culture were blending

It turns out that while I was busy churning out powerpoints and excel spreadsheets for a year, these accounts grew bigger and bigger. Then TikTok entered as a discovery channel and porposed a lively, entertaining version of most memes or more obscure accounts. And it covers the field very well: from parodies to more serious tutorials to humoristic brush-up on a particular subject, it’s a fascinating space

This answers part of the “why now” question for Public: while most “first order” players did very well at reducing friction, now is the time of massive discovery and social investing. Companies like Public seize the opportunity to organize and make the current chaos around social investing a fun, safeguarded and social experience

As per the fables of Jean de La Fontaine and perhaps contrary to the stereotypes of hedonism that the world bestowed upon us, the French tend to be ants rather than cicadas.

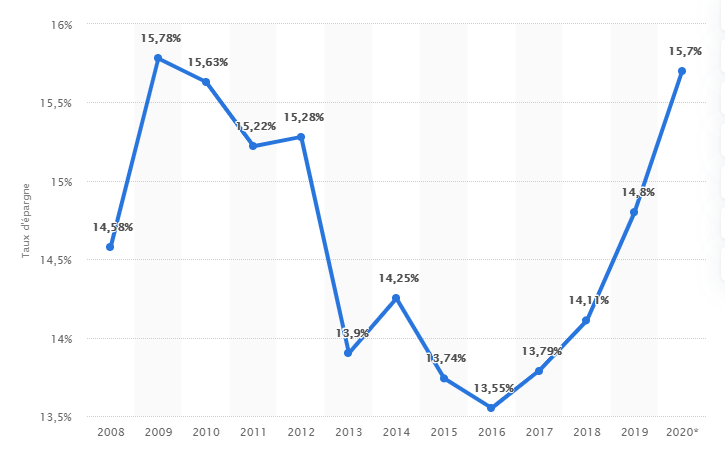

Let’s just look at the current situation per the last figures provided by the French statistical institute (INSEE) and the Banque de France ;

Savings are heavily skewed towards “the rich”. The top 20% earning households concentrate 70% of all savings. Between March and August of this year alone, 32% of the €50bn in additional savings stemmed for those last two earning deciles

The COVID crisis has sent saving rates (as a % of overall household income) to record levels. At roughly 15.7% as of the end of Q1 2020, they are almost back at post subprime crisis levels

The French majoritarily save in treasury bonds or “fonds euro” life insurance (32% of all financial savings $1,662bn) when directly and indirectly held stocks are are only a small fraction of financial savings (6,3% at $330bn)

There is indeed a large pool of savings to tap into. Granted, it’s heavily skewed towards the richer part of the population, but nothing prevents an ambitious player to replicate the Elon Musk Tesla Master plan: start from the top with a very profitable product for the top 1 to 10% of the addressable population, while you drive a second effort to address the following 10 to 20%, until your product is democratized. This happened with Robinhood and I believe it could happen with “second order” products focused on “Financial Litteracy As A Service” as well.

This part is obviously a work in progress. If there is anything subtle that I am missing especially on the regulatory side of things, feel free to let me know and we can dig deeper together.

About the regulatory stance in France :

My first impressions are that there aren’t any strong regulatory roadblocks preventing the emergence of fractional trading. I’ve perused on subreddits and forums discussing the absence of Robinhood in France, and it seems like most of the hardcore users have gotten on Revolut, Degiro, eToro, and other apps. Revolut is legally authorized to offer its trading component in the CEE space, which includes France and most big consumer markets of Europe

On paper and in vivo, it works but the bank identification is still in Great Britain and there is no automatic transfer. In the US, there is an an automated brokerage account system (PEA for the french people out there) that processes your transfer in less than 10 business days.

Even though the European Comission has moved to pass regulation to favor “open banking”, the French authorities have historically been very short of full-fledged accreditations for neobanks. The only so far to make the cut has been Memo Bank and it isn’t a consumer product

If a product like Public were to launch here, it would very likely face scrutiny not so much from a legal infrastructure standpoint but rather from a service intent standpoint: would community knowledge and advice be considered as investment advice ? Would some features disappear ?

About transferability and interoperability :

There’s a salient transferability issue that isn’t well tackled in the investment savings space. We’ve seen this previously, only a fraction of the stocks are held through traditional brokerage accounts, and from there stem a few problems ;

First, there’s not easy way to transfer stocks held in mutual funds or life insurance on brokerage accounts, even though the bulk of them is just sitting there ;

Second, the European Comission’s PSD2 directive on open banking and data ownership and governance has spurred a wave of open banking APIs, but most of them focus on retail banking use cases. Hence, I’m not really sure there would be an on-shelf infrastructure for fractional investing and reasonably cheap fees for ETFs or mutual funds

Third, the brokerage account interfaces are pretty weak and not focused on discovery at all. For the average French online retail bank user, discovery happens outside of the app or webapp and in a very antiquated way: on Boursorama.com forums, community is strong but very messy and the editorial work is focused on a “journalistic” output (as opposed to Pinterest-like boards or in-depth analysis of a stock)

About cultural barriers and current trends:

I think that it’s very curious how a number of French philosophical and political ideals are rooted in universalism, yet a lot of new entrants are focused on problems that target a very narrow demographic and/or community. We’ve seen it recently with a wave of neobanks targeting the young, the ecological hipster, etc.

From a purely entrepreneurial standpoint, it makes sense when most of the product innovation and infrastructure is already “on shelf” : defensibility can only come from how your users resonate with your brand in the long term. Most of the new entrants are dead set on acquiring and retaining, and believe brand is the most powerful vector to do so.

Contrary to banking use cases, retail investment is still in the first order phase: apps available for retail investment don’t fully tap into their communities, otherwise why would r/WallStreetBets and its many other variants around the world exist ? It’s really a product question, with community built into all of it rather than outside or as a “nice to have” feature (e.g. social trading copy feature).

As an optimist, I would bet that because of the uncertainty younger generations will face, financial literacy will be a hot topic in the next few years. The proliferation of sophisticated and less sophisticated scams (shoutout to the viral JP Fanguin and the MLM scheme behind him) shows that people fantasize yet are unaware of the tenets of stock market investing.

There is a clear opportunity, and I believe that a partnership-driven acquisition and / or channel sales driven model could be an entry point to explore, as opposed to the classical “banking maverick” that opens the rest of the financial universe.

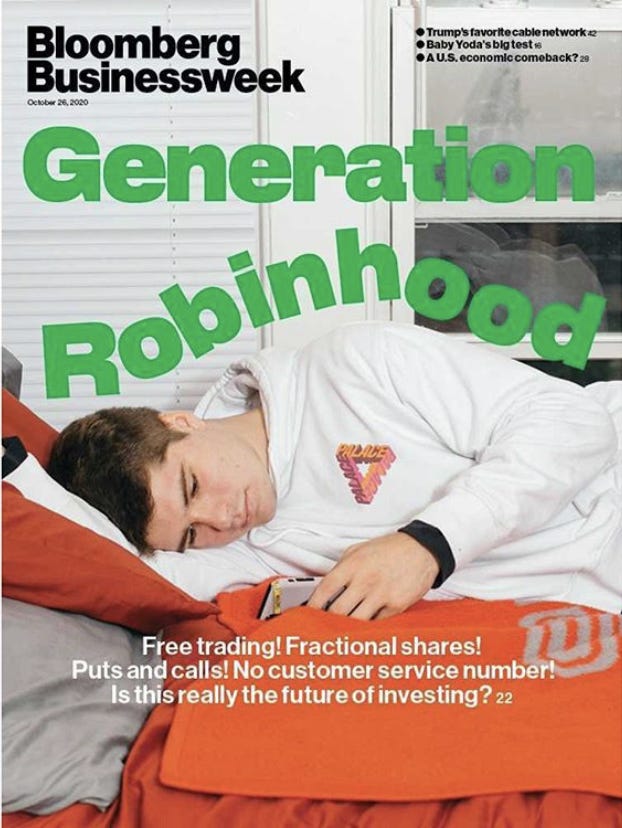

Market drivers: Robinhood walked so I could run (credits to Sidartha Jha on this one)

Now is a good time to launch and grow for a company like Public.com because Robinhood was the first-order startup that familiarized people and got them on the hook with the concept of fractional investing.

Fractional investing has become very popular because it is one of the first vectors that dramatically reduces friction, compared to how larger brokers operated. Regardless of the channel used, Robinhood went another rung down the latter of breaking investing into smaller bits that people can actually eat.

In other words: ETFs were created to enable diversification of retail investor mutualized portfolios, but fractional investing puts the power and intent back into the hands of the user and future investor itself.

Securities lending. Investors that short-sell, i.e. borrow stocks to sell them at current market price, then wait for the price to drop and use the proceeds to buy them back and profit off of this, need a pool of borrowers to lend them this stock. Through the firm that clears transactions for them, Public taps those investors and makes money lending them the stock they need, by getting a commission each time they do so

Interest on cash balance. That one is even easier. Whenever money sits in cash on your Public.com brokerage account, it is used by the company to be invested in treasury bonds that return 0.2%

Order routing. In some cases, the firm that clears Public’s transactions is able to execute a trade for a client and give Public commission on that trade. This is called a rebate, and is another revenue stream for Public

Subscription revenue. Public states very blankly and publicly on their own website that the platform as is will evolve and include “premium” products or features that will involve some subscription revenue

For this type of business and in the absence of subscription, LTV is likely to be driven by engagement, as in how many trades and of how much a person keeps on their brokerage account. This will increase the total assets managed by Public and in turn generate more opportunity to use the stock and cash of clients to make money, and will also drive the number of transactions and with them, other transaction-based opportunities to make money.

It’s a pure engagement business and is why community by design is very important to succeed with such a product. Along with the frictionless interface, and the content-rich discovery experience, the community drives user engagement and retention.

Everyone is able to do a skeuomorphic user interface à la Robinhood with charts and have a simple and usable trading app. In my opinion, it’s much more difficult to design an entire app around making investing more reassuring and easier.

Robinhood, eToro and others invented and popularized the sacrosanct dashboard, inherited from the first mobile bank interfaces. Public goes beyond this by adding social and discovery features to the mix :

Group chats. This is really powerful, as it repositions conversation inside of the app, and effectively turns into a formidable engagement lever for the firm to build on. Discussions that would normally happen in forums, social media can now happen inside. One of the disadvantages is that they are close ended, as opposed to a Twitter thread for example. The virality, similar to Snapchat for instance, stems from small one-to-one or few-to-few but fairly regular interactions

Feed. On your feed, you can post trades you make along with a fairly small blurb of text (one or two sentences) to share with your followers your investment rationale. In my opinion, this could largely be complemented by a comprehensive system of posts and blogging, similar to Seeking Alpha but much more mobile and “rich content” (audio & video) friendly. This is typically where a product like Seeking Alpha is very expensive for a consumer opportunity ($17 to $30/mo.) but could be repositioned as a consumer subscription product within the “Netflix anchor” ($8 to $10)

Boards and themes. This is the “Pinterest” discovery card. The beauty of this is to be able to turn a boring collection of stock picks into a beautifully designed board or theme, illustrated and curated by in-home experts. Suddenly, it’s a new editorial style. And there are other possibilities, such has harnessing a generation of social trading influencers as a source of quality user-generated content

Day trading ban. Public made a very intentional choice with this one feature. Upon signing up for it, you agree that you can’t buy and sell the same stock or piece of an ETF the same day. Some would say it’s foolish because the day trader population is the most engaged of all, which is a good point. But as a second order startup in the mobile trading game, Public has to bring a different intent to the table and is on a mission to educate people to long-term investing and deeper analysis. One difficult challenge is being able to recreate but safeguard the fun and wild spirits of trading subreddits (memes, memorabilia, etc)

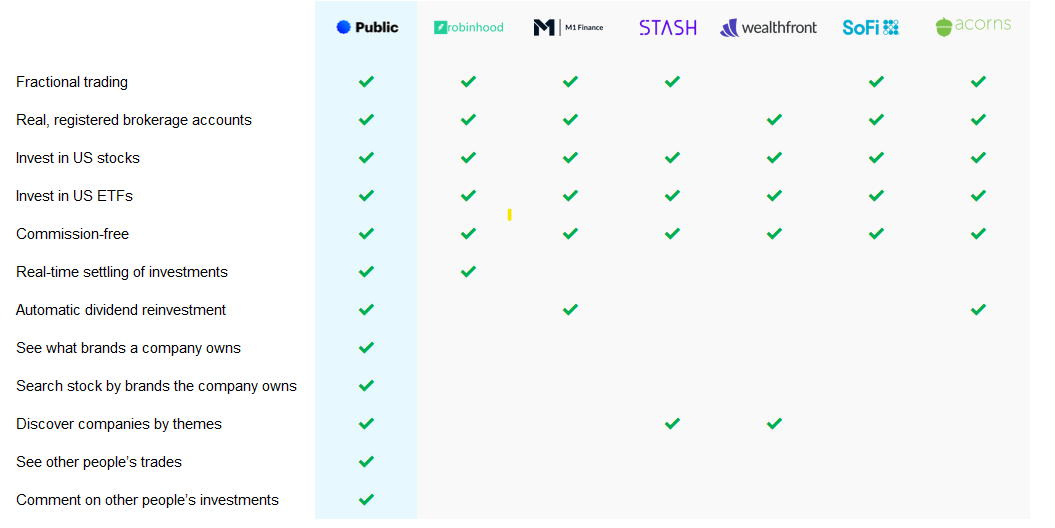

Building on all the info available, I’ve built this quick benchmark highlighting that Public has all the nice to have features that popularized traditional trading apps as well as its own “social spin” where there are merely two competitors trying some discovery features.

⚠️ A call to arms ⚠️

If you are in France or in Europe and building something similar to Public.com with or without some degree of financial literacy education in it, please do ping me ulysse@techmind.vc and I’ll be stoked to discuss !

Otherwise, see you soon for another issue ! :)