Hi everybody ! This week I’m going to dig up my archive, and wanted to share with you a memo I wrote about coliving company Colonies a while ago.

Since I’m late again, I made sure to give another €50 to my friends at Article 1 (super cool non-profit mentoring people from disadvantaged communtities), go check them out !

Before I let you all free to wander in this memo, may I ask for a quick, unrelated favor ? If you’re reading my newsletter and we have never, ever talked, I want this to change. Reach out at @LarocheUlysse on Twitter or ulysse@techmind.vc, or I will eventually 😉.

A lot of people reading this are students, aspiring entrepreneurs or entrepreneurs. Recently, I was told some horror stories about people sleeping on the floor at Station F and other places etc, because finding a place to stay was and still is abruptly hard for these demographics. Coliving spaces are often designated as one of the possible ways out of the housing crisis.

On a more general note, the overarching coliving trend is frequently criticized for being a marketing stunt to aggressively promote “colocation” to well-off young graduates given that they are not (yet) below market prices for normal, amenity-poor apartments.

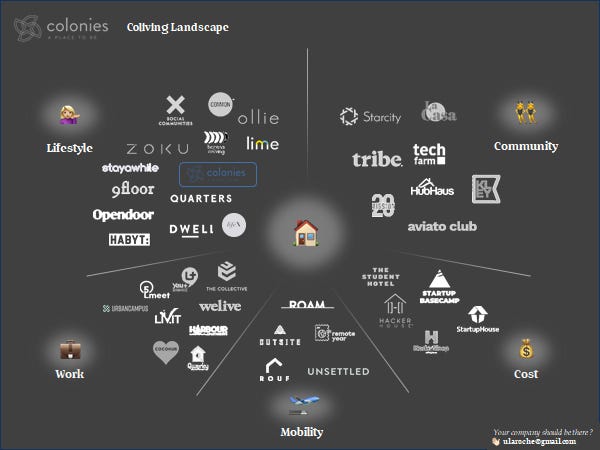

If you read all the way through the end, you’ll see that I mapped the companies I know of depending on whom it targets. But digging further, we can see that there is at least three models, two of which are “venture-backable” types of companies :

Builder-operators, providing “Housing-As-A-Service”. Colonies is part of that first category. It takes investor money to buy, completely remodel real estate and then fill it with tenants and operate it. In some cases, it also participates in creating brand new businesses. This model is typically venture backable because it is moderately capital intensive, it generates steady and predictable revenue, it has network effects at scale (mainly supplier bargain and usage data).

Marketplaces. Another really interesting model is marketplaces. Most co-living marketplaces are not built around the idea of “go live in a very well furnished and perfectly optimized space”. Rather, they are lifestyle or cost-oriented, meaning that they will sell you an ideal of what your community should look like, a cheap rent, or both. Colette Club, a great company that I’ve already discussed on here, does just that: it sells you the unsuspected cross-generation lifestyle and the cheap rent for a room in a fla/house with large functional areas (kitchen, dining room, other amenities etc) .

Full-stack builders. The last model is a less venture backable (but very valid altogether) option, for it implies that funding euros will go directly in investing into some pieces of real estate, before leveraging successful projects to get a bank to partly finance them. I have seen some scarce examples of companies running more than 5 projects at once with this model, but it is quite difficult to scale unless you are a professional builder with tons of experience, network, relationship with financing partners etc.

Now that this quick add-on is out of the way, time for our memo.

Last summer, I was leaving New York City and desperately looking for a place to crash at minimum cost and maximum flexibility in Paris, so that I could start looking for my next gig.

At the same time, I was witnessing the "We Company" debacle unfold, and trying to ponder what they had missed so badly on nailing the unit economics of sharing spaces to work (WeWork) and live (WeLive).

I wrote this little piece about Colonies, which at the time I found to be an interesting company ripe for scale. Given their €30m Series B and their €150m property financing partnership with private equity fund LBO France announced right before the lockdowns, it seems like I'm far from being the only one now.

Disclaimer: My view on Colonies and co-living unit economics in general isn't reflective of reality , and I'd love to discuss any counterpoints you'd like to make.

Colonies provides a hybrid housing experience with private spaces similar to a studio apartment (with kitchen and bathroom amenities), coupled with shared areas thoughtfully designed for collaboration and community living (also known as Coliving spaces).

The primary target is students and young workers, for which Colonies simplifies and streamlines the painful and complex process of hunting for a flat, and crafts a more seamless and flexible tenant experience.

What are the must have pain points addressed?

Increasingly expensive housing relative to income growth, especially in younger age groups

Broken tenant experience, due to painful and inflexible administrative framework (3-year reglemented leases, unstandardized and undigitalized application processes)

What are the nice to have pain points addressed?

Fighting younger age group and young professional isolation trend in big cities across Europe including Paris

Addressing the lack of shared, higher-end amenities (gym, coworking spaces, cafés and bars, etc.) in larger residences/condo complexes in France

For the French & European market, the need and product-market fit is more obvious. Community-based living and amenity-heavy buildings are rarer compared to other markets such as the United States, where real estate developers have invented the amenity-rich model that coliving operators tend to copy on the Old Continent.

Since Colonies is primarily appealing to your typical young worker or student, and only operates in Paris at the moment, let’s look at some relevant numbers:

According to INSEE (french statistics bureau), there are 1.7m qualified workers in the greater Paris area, 11% of them under 30

If we suppose that Colonies is standing right in the mean monthly rent, they’re paying c.€850/month

Assuming the above, that would amount to this population spending about €1.9bn on rent every year. If you assume that Colonies can capture 5% of this addressable market and retain a 15% commission, it can easily make €20m ARR. And that’s only with its primary target, in one city.

While the company is currently focused on its primary geography and demographics, great moves for the future could include expanding to other European capitals where similar needs are prevalent such as London or Berlin, or expanding to senior residences.

In terms of coliving space required to reach this target, that means they would need to accommodate 9,000 people, and with an average of 10 people per coliving space, it means 900 places in Paris (see the business model section for more details on the economics).

From product to system : A pure capitalist enterprise

There has been no communication so far on tenant experience software and app product features. I believe this will be key in:

Establishing their product as the best experience for tenants, and ultimately building a great brand

Giving confidence to landlords that the low level of friction in building management is worth the price they’re gonna have to pay to work with Colonies

Helping the company scale its operations by eliminating user friction and digitalizing the tenant experience to the maximum

Having said that, I honestly think that digital tools, in this kind of business, are nice-to-have. In fact, being a successful coliving operator ressembles a lot the franchise restaurant business: you need to consistently deliver the same amazing experience over and over again, create unique spaces with a replicable method on top-notch real estate, and use the least amount of your own capital as possible.

Thus, your product is a system for building, modeling and filling beautiful spaces with tenants. It’s double-ended, because you need outside capital just as much as you need tenants to fuel the machine.

Semi-commons

Colonies’ business is centered around the “semi-common”idea. Most remodeling projects it will get into are centered around the idea that functional areas (kitchen, shared office, etc etc) are as important as individual studios in one of their buildings.

The tension is between constantly optimizing for space while maintaining a top-notch experience of semi-common areas: functional rooms where you could be doing your own thing, but also actively partake in community activities (spontaneous or planned).

In more vertical cities like New York, amenities-rich buildings and developers behind them have perfectly understood this and have mastered the art of creating beautiful semi-common spaces and amenities of all sorts.

Alexandre, the founder and CEO, has a real estate investment banking background, which helps when in need of figuring out sane unit economics and reaching out to investors for fresh cash to use for new projects.

Colonies' main challenge post Series B is being able to source and develop projects, and do it faster every time it completes a new project. The learning curve ahead is going to be a tough nut to crack, because the founders are going to have to source both business and sales (Expansion team, Real Estate analysts, etc.) and technical profiles (architects, interior designers, etc.) very fast over the next few months.

Recruiting and staffing optimally for best-in-class project execution will be key in Colonies’ growth trajectory and ability to deploy its private equity sponsor money in new projects.

As I said, these economics are based only on my analysis and the information available online and discussions with friends with experience in real estate. They’re not real company numbers, hence it’s best to take them with a grain of salt. I’m more than happy to discuss if you feel you can add more color !

Making it work better than “We” did - Simplifying the equation

As the WeWork saga unfolds, economics in PropTech and especially in the coworking and coliving verticals have become a very hot debate topic.

Unlike some of its coworking and coliving peers, Colonies has chosen to eliminate the risk that leases represent by positioning itself as a Housing-As-A-Service operator. That means they are only going to source, develop and manage projects.

In this type of scheme, the company claims a monthly cut on rent, and can also charge management fees to investors and landlords for putting their property to work.

For the interest of exhaustiveness, I think the best example is Colonies’ Lazare House project in Paris’ 20th arrondissement, for they have disclosed interesting cost details about it.

Quick overview below to grasp the key numbers.

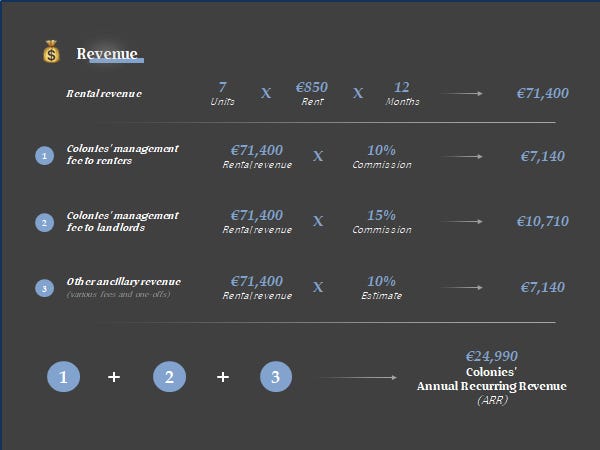

A possible revenue model for the company

In my opinion, a coliving company can make money in three simple ways. For the sake of clarity, we’ll estimate each “cut” it takes as a percentage of the annual rental revenue for the project to compute ARR.

This only reflects my view of a possible revenue model for the company and I’m happy to take any counter-view on the topic.

Sourcing and building - The initial costs

Landlords own 100% of the place. Depending on the project, operators can and will handle anything and everything from sourcing and renovating the place, staffing an architect, finding the contractors.

Some estimates below to help get a better sense of the costs involved.

Running and filling spaces - The recurring costs

Now that the perfect coliving space is up, it needs to be running smoothly. As it is Colonies’ value to find tenants and guarantee the greatest experience, the acquisition and staffing costs are on them.

Then, landlords are in charge of the costs they would support and pass onto their renters in a typical building.

Some of these costs can be reduced upon scaling the company. With regards to sourcing, the company will likely have higher costs as it stabilizes an efficient methodology.

Conclusion

With more maturity and scale in operating spaces, it’s likely that a portion of these will decrease over time, as bargaining power in purchasing increases.

Under our assumptions, we’ve got a relatively high margin business in which Colonies will need to focus on containing sourcing and user acquisition costs, while partner investors and developers will pick up other initial and recurring costs.

Below is a simplified statement to sum that all up.

Traditional factors

For Colonies, offering a great and seamless experience can create defensibility around switching to another housing solution. Let’s note, though, that if coliving becomes very accessible and widespread in the future, switching costs will naturally shrink.

Community building and brand image are also key aspects in my opinion, as they will determine the firm’s ability to attract and retain users.

Hence, velocity and excellence in scaling operations quickly, while still offering beautiful space design, top experience levels and consistently deliver on creating and maintaining great communities will be instrumental.

Scale is also dependent on offer diversification and segmentation. While the young working adult makes for the most obvious case, other populations could benefit from this type of experience (for instance, elderly people appealed by community living and in stronger need for amenities and support).

Capital-as-a-moat

The pre-covid €150m project fundraising from LBO France is illustrative of the knowledge the founders, in particular Alexandre, have of the real estate market: if you want to build a non-capital intensive business, you need to convince third-party investors to finance your projects before (i) Your competitors do (ii) Larger incumbents with significantly bigger capital ressources get as good as you at building.

Who are the preferred partners and investors going to be, to source the underlying real estate projects ?

The only real distribution moat that Colonies can thrive on is early virality from being a first mover in the space.

Just like its peers, word of mouth and clever PR actions help in kickstarting the business, but long-term brand equity is what will distinguish clear winners.

Hence, the ability of the team to blitz-scale operations, get adequate funding and establish a strong B2C (tenants) and B2B (real estate partners) brand early on is key. Indeed, once the space becomes more dense and well-funded, investors will be reluctant to finance new entrants in fear of cannibalization.

Contrary to acquisition patterns in coworking businesses, coliving companies strive to acquire users one-by-one rather than by larger groups.

This individualisation results in higher CAC. It’s important to keep that in my mind, even more so in the coliving space where LTV is going to be fairly low as users churn rapidly (c.6 months stay).

Taking businesses like WeLive as a benchmark, you can estimate it to be around 15% of revenue; then expect additional costs linked to upstream acquisition as competition for larger scale projects will often be subject to tendering processes.

I wouldn’t be surprised to see major public housing offices in France pit development and management companies against one another like Colonies in upcoming tenders. As of now, Colonies has already won two major Parisian projects in La Défense and Arsenal, which looks encouraging

In my opinion, the most relevant segmentation criterion to pin down Colonies’ direct competitors are usage and geography.

Colonies competes in the lifestyle-oriented coliving market. Therefore, it will cater to people that have access to the traditional housing markets but are appealed by the range of services and the premium experience they can get for the same price point or cheaper than your typical apartment.

It’s important to make that distinction, in the sense that the renter’s cost-effectiveness is a meaningful argument but not central to the value proposition of Colonies.

To further explore the field, I’ve created a preliminary landscape of the global coliving players (and two recent projects not included : Homies and Colette):