Disclaimer: Definitions and angles for this essay are obviously very subjective and hopefully will prompt debate. This is simply a voluntarily biased and incomplete attempt at unpacking the term.

Nothing would make me happier than discussing this with you. What’s your idea and definition of circular economy ? What use cases did I miss or exclude ? Which do you love most ?

To introduce circular economy, I could’ve delved into natural ressources overrun dates, our concerning and growing debt in key rare earths, or any other commonplace statement, once again drowning you into a panic attack or a disillusioned sigh.

I’m not going to do this.

The circular economy is like impact investing. If we don’t do the homework, roll up our sleeves and ask ourselves what it really means, it’s set to become a distorted and overused term weaponized by corporates and investors for greenwashing and wishful thinking.

In search of drawing a comprehensive picture of new approaches to our economic systems and our way of managing natural resources, I thought that exploring a few premises and traits would be a healthy start.

Any thought exercise about the circular economy should begin by asking ourselves why this concept is back into the limelight in the first place. Industrial and technological progress have advanced at a dizzying pace, and many signals point us to the fragility that our way of extracting and using resources have ingrained deep fragilities in our systems.

As a Black Swan Event, the current health crisis has shone a very crude light on those, and it has reminded me of Nassim Nicholas Taleb’s hierarchy and theory of systems.

In his view, any entity and/or system falls into three broad categories:

Fragile - Those who fear and brace for unpredictable events

Resilient - Those who remain indifferent of unpredictable events

Antifragile - Those who are built to profit by design of unpredictable events

The VC world has shown a lot of interest for the latter, in light of the multi-faceted crisis we’re going through. Investors have set out on a quest for antifragile organizations and businesses whose DNA and competitive advantage would further amplify in trying times.

In a fragilized socio-economic compound, stacking capital in the most antifragile organizations seems to be the only viable bargain. But as embattled as we are, we tend to forget about how important resiliency is as an intermediary but very much necessary step towards overcoming our own faults.

Attempting to define circular economy, trends and features within this ecosystem is first and foremost asking the resilience question before thinking about anti-fragility.

When an entrepreneur ventures in this space, it’s an attempt at quickly modifying a micro-economic system to optimize finite resource consumption, all while aiming at de-linearizing value creation stemming from it.

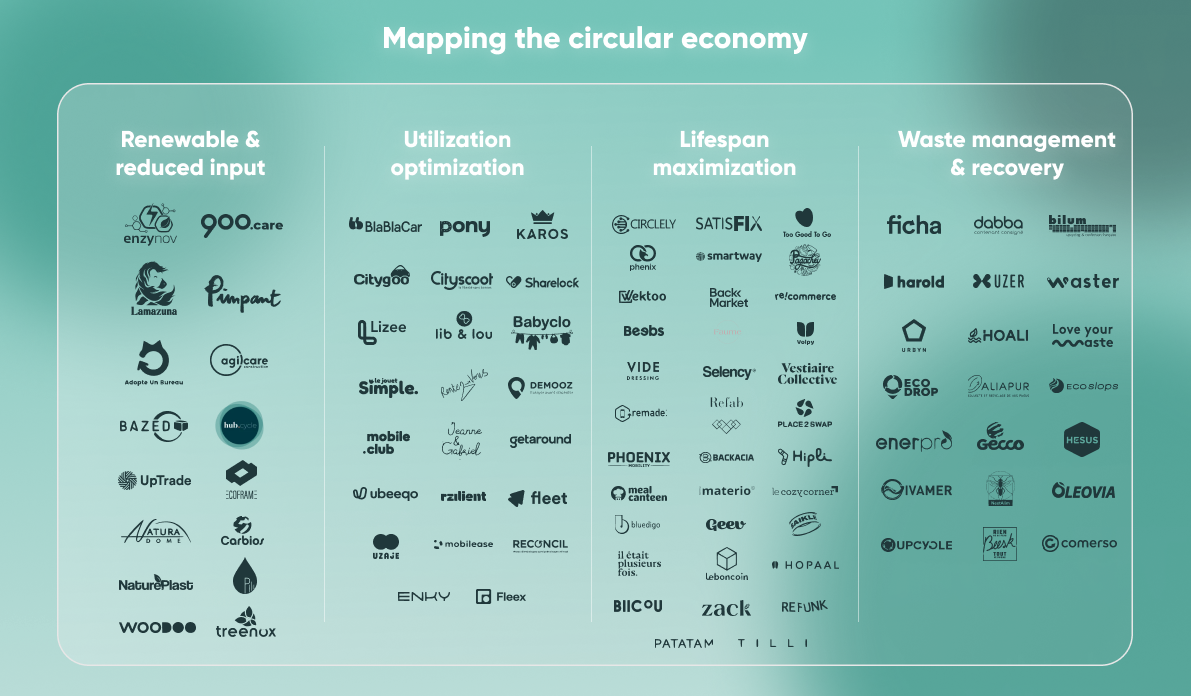

This effort can take broadly different directions, ultimately as much as there are systems or swaths of systems to evolve. Rather than pretending to exhaustivity, let’s try to make a good enough synthesis and narrow down to four problem groups:

Making and designing things using less resources

Optimizing and maximizing lifespans

Striving to optimize utilization of items

Managing and handling waste

Making and designing things using less resources

In this pursuit, entrepreneurs will focus on resource allocation and layout in designing and making things. The premise here is to bake-in build or design innovations that turn the table in usage, business models or both.

In this regard, there is several sub-trends that I thought worth touching upon:

Eliminating sub-optimal use of resources in a product. Rather than just marketing a product made with so-called natural components, some entrepreneurs have chosen to reformulate and reexamine packaging and primary build of products. As an example, Aymeric and Thomas at 900.care have designed water out of their subscription-sold personal care products. In doing this, they reverse the economics and mint a new DTC distribution channel for products that were, until then, mostly unprofitable out of the retail world

Betting on modularity and scalability in construction. Beyond residential and leisure applications for consumers (tiny houses, refurbished vans, eco-designed house makeovers), pre fabricating collective use buildings has made significant progress: more and more entrepreneurs have ventured in augmented service models where architecture, design, elevation, assembly combine in an elegant and scalable way to build more durably. The next step could very well be to increasingly financialize this approach and let financial partners or even retail investors in search for attractive commercial real estate yields carry the necessary investments

Combining several ressources to leverage unique properties. Historically, complex alloys in primary building materials were metallurgy’s preserve. Nowadays, a number of new innovations are underway in less obvious alloys. Woodoo’s team, for example, has created a unique alliance of wood and bio-sourced polymers with surprising properties: they devised several prototypes of wooden panels that offer this unique minority report effect straight out of a SF movie

Absorb and dispatch unused material supply. Historically, marketplaces linked to primary and transformed materials were pretty rare. Things have started to evolve in several verticals: scrap pieces of fabric and excess inventory in clothing and garment manufacturing (Uptrade), industrial waste upcycling (Hub.cycle). Corporates are trying to play catch-up: LVMH just launched an initiative to better tap into its supply chain and dispatch unused materials to potential clients

Optimizing and maximizing lifespans

A broad second group of use cases for the circular economy is linked to the optimization of utilization and lifespans for day-to-day objects catering to essential needs: eating, moving, communicating, putting clothes and a roof upon one’s head.

A great swath of general consumption needs have been subject to digitization attempts, and professional needs are less and less outdone.

On the French and European markets, it’s a three-fold progression:

The first wave catered to the most salient use cases in marketplaces, and was born right before or in the aftermath of the dot-com bubble and the cambrian explosion of the tech ecosystem in Europe in the 2010s: Leboncoin (1999), Covoiturage.fr, who then rebranded to BlaBlaCar (2004), Backmarket (2014), Vestiaire Collective (2009), Vide-Dressing (2009), Vinted (2012), etc

The second wave was that of the massive deployment of capital in free-floating mobility. As surprising as it may seem, this type of mobility actually sprouted up in the mid-2000s and was tested out by Vulog, a French Riviera startup experimenting around small-sized EVs (2005 to 2007). The concept was then reinvented and appropriated by Asian companies the likes of Ofo and Mobike before coming back in Europe around 2017 (Lime, Jump, Voi, Dott, Bird, Tier, Coup, Cityscoot, Pony, and many others), in an arms race where a lucky few survive the capitalistic Battle Royale of this absurdly competitive market

The third wave, exploding amidst the current health crisis and the fragility it brought, is that of specialized marketplaces and augmented services around the broader circular economy ecosystem. A myriad of companies compete with the incumbents, either by (i) unbundling and shaping a different and deeper experience of a particular use case (ii) scaling, digitizing and modernizing a bundle of services (iii) organizing more complex B2B transactions thanks to a specific technological edge

LeBonCoin, the mother of all marketplaces

This marketplace is probably the first (and in some cases the only) point of contact to the internet for many French people outside of Gen Y and Z. My mom probably uses LeBonCoin more than she uses WhatsApp or any other Facebook product. It’s the ultimate usual suspect.

Let’s dig in a little bit ;

LeBonCoin is actually a copycat from Swedish classifieds site Blocket.se. After buying out the site in 2003 for €19m and expanding it to the rest of Sweden, the now famous Norwegian publisher Schibstedt has its eyes on the French market. To set foot in 400-cheese country, Schibstedt cuts a deal with Spir, a subsidiary of media group Ouest France. At the time, the company was specialized in printed classifieds and had only just started to foray into classifieds

In 2010, Schibsted became the only shareholder of LeBonCoin, who had finally turned a profit the prior year by monetizing via advertising and upsell tactics like temporarily featuring listings against a fee, adding extra pictures to a listing, etc.

In 2014, LeBonCoin opened a crucial monetization channel by ending the gratuity of all listings posted by professionals. This strategic move would eventually pay but triggered the withdrawal of 500k postings in the month after it

In 2016, the company entered an acquisition spree in various and less covered verticals at that time: Agriaffaires in the farming universe, A Vendre à Louer in real estate, used car sales with Argus, clothing and accessories with Videdressing

In 2019, Schibsted announced a split between its publishing business and marketplace portfolio, which it will name Adevinta. At this time, Schibsted is still a majority shareholder in the company (59%), whose share price soared +75% in the last twelve months

In 2020, Adevinta acquired Ebay Classifieds for €8bn in order to consolidate its dominance of the space

LeBonCoin’s ascent as a circular economy flagship in France and Europe is that of a strong brand, encapsulating a spirit and values to which millions can identify: a pragmatic, local and humble business.

According to a sociological study led by advisory firm SORGEM, the boncoinistes buy an itemas opposed to a product, without necessarily looking to turn a profit. In that respect, the approach is very different from Ebay. Although it was founded by Frenchman Pierre Omidyar, Ebay has a fundamentally transactional and “hustling” component, where auctions make users more money by favouring speculation.

As for LeBonCoin, this reflects in a number of product biases:

Minimalist, feature-poor design when compared to other vertical competitors

The remarked and heavy presence of display advertising, while vertical competitors eliminated it pretty quickly (16% of Adevinta’s revenue still comes from advertising in 2020 and this doesn’t include feature fees)

A strong emphasis on proximity and trust, voluntarily holding back on any secure transaction or payment modules in products

Those who know LeBonCoin will see the paradoxical tension here: those 3 pillars are at the same time a brand asset and a product risk to mitigate in the short to medium term.

As users have more and more touchpoints with other specialized marketplaces and B2B apps, the playing field levels up from a UI and design perspective. It’s now pretty obvious that what’s so charming and attaching about the brand is also what can and will tempt users to move away from some (perhaps many) categories.

LeBonCoin’s product team is self-aware, and has worked on a number of solutions:

Secure payment infrastructure

As was the case with generalist competitors such as Priceminister, secure payments were increasingly becoming the bull in LeBonCoin’s many china shops. In 2020, the company eventually introduced a secure payment system, but it still works like an “escrow on steroids”

The experience could definitely be better. Indeed, it’s still possible that multiple buyers will escrow funds for several by only making an offer on a listing for an item that already sold on or outside the platform

Discovery and targeting

Searching for an item on LeBonCoin is still very close to hunting for a bargain on your Sunday small town brocante: you’ll grope a lot to find a good pick, and listing recommendation is still dominated by a lot of display ads. The format of ads does not really remove the obvious friction barring users from quickly finding what they’re looking for

In its current state, LeBonCoin as a product will have to evolve to match the standards of the best second-hand marketplaces, by emphasizing algorithmic personalization and geolocated recommendations. In LeBonCoin’s CEO own words: “We will personalize the experience by universe. We want usage to evolve so that there will be as much LeBonCoin as there is users rather than a BonCoin for all”

Delivery - Historically, LeBonCoin had not developed an expertise around delivery and has seeked the assistance of the Mondial Relay network, encouraging users to get out of a strictly local transaction area and go national. This should massively haul sell-through rate in various brackets where competitors marketplaces have baked delivery in the product (duh, you would say)

LeBonCoin unbundled: a giant with clay feet ?

74 distinct categories. €27bn gross merchandise value. 1% of France’s GDP transacted every year and growing. 50% total users are DAUs.

While the general public is intimidated by the sheer scale of LeBonCoin, entrepreneurs instead see an opportunity to aggressively unbundle categories and strive to shape a better experience and leapfrog the giant.

As the homogeneity and simplicity of the LeBonCoin experience have grown into handicaps, opportunities have emerged in the last ten years:

Consumer electronics and appliances

The time is late 2014. A joyful revolution is at play in a seemingly boring market where planned obsolescence has become table stakes. By first foraying into smartphones, Backmarket moves very fast and establishes a seamless purchase experience, and slowly picks up many adjacents: cameras and lenses, connected things, small appliances, professional copy machines, etc. Hanging onto their wheel, incumbent retailers such as Fnac-Darty are trying to leverage their trust goodwill to stay in the race

Henceforth, Backmarket has to keep building muscle in its two legs (i) state-of-the-art, data and AI-enabled quality assurance (ii) rapid expansion to new geographies to hopefully compete at a global scale

Clothing and accessories

Another ultra-liquid category and poster child of the circular economy is obviously second-hand clothing. Vestiaire Collective (founded in 2009), VideDressing (founded in 2009 et acquired by LeBonCoin 10 years later), Vinted (founded in 2012). Those platforms have succeeded - to some extent - in crafting an elegant, convenient and practical experience to take fast fashion by the rear by better organizing second-hand markets

Gradually, a price war and transactional climate has set in, both between users and between platforms themselves. This pushes this industry to a new social and community-defined frontier. The advent of Passion Economy, the consecration of paying communities and of the consumer subscription economy are a great catalyst for entrepreneurs. It’s a thesis on which Beebs (baby and child clothes and accessories) and Campsider (outdoor sports) have for instance been experimenting with

Brands are playing catch-up. Faced with marketplace competition and starting with the higher-end of the spectrum, brands have sought assistance of new players like Faume or PlaceToSwap in implementing a turnkey, white-label technology to (i) drive traffic and stickiness for their main range by offering a proprietary secondhand shop (ii) drive traffic to their stores by enabling in-store drop-offs and redeems (iii) handle the logistics for them

Optimize utilization for what we use to live and work

What we’ve long called the gig economy can actually be considered as an entire swath of the growing circularization of our economic systems. For consumers as well as businesses, this transformation is based on on two premises:

Progressively turn investments into variable expenses we make to live or work

Optimize fleets of consumption items, vehicles, industrial equipment to maximise their utilization and hence reduce their impact on the environment

This transformation has touched a number of sectors, leading with:

Mobility: As we touched upon, free-floating mobility has taken the world by storm since 2017. In the race for maximization of utilization for vehicles and mobility assets, the most visible and controversial trend is far from being representative of the variety of uses cases to tackle. Of course, there’s also the vas carpooling industry which French entrepreneurs pioneered (BlaBlaCar and BlaBlaLines, Karos, Cityogoo, etc), consumer-to-consumer car rentals (Drivy, which got acquired by US player Getaround for >$300m in the spring of 2019, Koolicar, Ouicar). Others have taken another approach such as Pony, whose fleets actually belong to a community of pony angels who acquire vehicles which it floats back to the street, sharing revenues with its angels

Consumer electronics: BackMarket has led the market in refurbished smartphones and other electronic devices, others have chosen to place a bet on subscription and usage-based business models - Akin to Damien Morin, Save ex-founder who bounced back with Mobile Club, a leading subscription-based smartphone leasing service. Story has it that Mobile Club could have been a joint venture with Illiad CEO Xavier Niel, but that Free eventually passed on the idea to focus on its own leasing plans instead. Gradually, new categories are opening up: Fleet, for instance, wants to make IT equipment leasing a seamless experience for small and medium businesses and enable them to turn associated CAPEXs into OPEXs. For high-growth companies whose headcounts are on the rise and where needs evolve for a given employee over time, it’s an opportunity to variabilize this incompressible expense

Office equipment - As a category, office equipment has often been grouped in augmented services in office design services. That was notably the idea Kymono, a “Culture Design” company spun-off from The Family experimented. The pandemic brought a new wave of furniture leasing companies in the limelight: Enkyand the concept of Furniture As A Service, and its marketplace where individual investors can acquire office equipment then leased back to the company’s clients and Fleex, who enables employers to make high-end work furniture and appliances a perk of its own for companies who want to keep a competitive edge in culture building and talent wars

Other items - Others want to impose a more holistic vision in the leasing of everyday consumption items: For example, Lizee is to “Leasing-as-A-Service” what Alma is to is to the “buy now, pay later” trend. Lizee is already working with several clients, in industries mostly focused on retail: major sporting goods retailer Décathlon, luggage brand Delsey, and iconic department store Les Galeries Lafayette. This emergence of players pushing a more holistic approach signals the growing legitimacy of this business model: this consumption upgrade can become a programmatic feature handled by a third party for the benefit of retailers and brands

Handling, minimizing and valuing waste

I voluntarily delayed talking about this subject until now because it’s probably the most invested by the general public and politicians, because it’s representative of the premises of the circular economy: the golden age of recycling and the incumbents: Paprec, Suez, Véolia Environnement, etc.

Sorting and valuing waste is a long time in the making. Until 1870 in France, anyone could literally dump its waste onto the streets, and the first trash cans weren’t invented until a few years later. In the aftermath of World War II, the handling of waste and recycling mostly progressed in the construction industry, where gravels from war ruins started to be recycled to compensate for the lack of primary building materials.

In 1975, local administration was put in charge of sorting and recycling as well as collection of waste, then In 1992, the Royal law (not as in the Royal family but more like former ecology minister Ségolène Royal) obliges them to comply with nation-wide regulations on waste management.

Technical progress was faster than usage and logistics for local administration, businesses and individual end-users.

This created a number of opportunities:

Mass retail - Before being a moral priority for retailers, waste minimization is first and foremost a compelling profit optimization opportunity, where volume makes or breaks margins. If losses linked to waste tend to be priced in by retailers and manufacturers for a long time, the regulation in France is pretty advanced compared to neighboring EU countries. The anti-waste law on the brink of promulgation simply forbids to throw away or incinerate unsold products. These constraints created a new opportunity for players to educate and help retailers to this stake. Smartway (formerly known as Zéro Gâchis, in which Evolem is a proud shareholder 🥳) is precisely tackling that issue: creating an intelligence layer for retailers and manufacturers in anti-waste efforts. With a lot of perseverance and countless iterations, Smartway has progressively (i) proved that retailers can and want to get control on anti-waste (ii) tested over and over a number of different solutions for them (iii) built based on this experience a labelling and dynamic pricing technology with no serious rival to this date

Collecting waste for local administration and businesses - Incumbents I’ve cited before have been very quick to react to the creation of lucrative public tenders, in part because of the porosity between law-makers and executives at former state-owned conglomerates like Suez and Veolia, and the value proposition to cater to them. Those players have evolved at their own pace, and have a hard time enabling a data-driven experience. In addition, their historical know-how wasn’t to care about user experience, whether they catered to citizens, local administrations or businesses. As for many issues linked to waste management and ecology, political voluntarism has outpaced the industry itself. Once again, the offset creates interesting opportunities. On the local administration side, players like Uzer enable the unlocking of massive chunks of data to augment the experience of end-users as well as administrators. For businesses, companies like Urbyn have positioned themselves to avoid frontal competition with incumbents, but as aggregators in a complex network of suppliers, not so simple to handle even for big businesses. Before shooting for efficiency, the first step is to give insight to an industry who has often operated with limited data

Closing thoughts

At Evolem, which I joined earlier in the beginning of this year, we are very bullish and optimistic about the future of the entrepreneurial and non-profit ecosystem of circular economy.

It’s a secular challenge about the transformation of our economic and social systems whom we have barely scratched the surface of, towards a more resilient society.

Last year, we launched Domorow, a philanthropic initiative whose mission is to support non-profit organizations in the sustainable development space, focused on three overarching goals: (i) funding research and innovation (ii) educating and sensibilizing the public to those subjects (iii) promoting initiatives in the circular economy.

We’re already supporting great projects, two of which are specifically focused on circular economy:

Atelier Emmaüs is a non-profit committed to an inclusive ecological transition, who renovates and manufactures design furniture and offers innovative solutions in scrape wood-based raw materials. The organization also promotes re-insertion of excluded population groups

Rejoué is a non-profit who contributes to environmental protection by reducing the waste linked to toys by developing repurposing. It collects, assembles, cleans and sells used toys, once again by promoting marginalized groups in its workforce

As for the venture team at Evolem Start, we’re obviously super eager to meet and back entrepreneurs in the circular economy. 🤗

If I missed your company in the mapping, just shoot me an email over at ulysse.laroche@evolem.com and I’m more than happy to chat !