Today, I wanted to dive into an under-discussed and un-sexy topic : AgeTech.

AgeTech covers any and every innovation towards helping our elders live a more decent retirement and end to their existence. In France, it is also usually referred to as “La Silver Economie”.

To kick off, I found it useful to quickly brush on the interesting data points supporting the growth of this space :

Aging is an important topic: it’s going to be involving over 2 billion people >60 years old by 2050, let alone families aiding them. Globally, the expenditure is slated to boom to over $1 trillion

To put in perspective and underline how much white space is left, AgeTech takes up only 1 in 40 dollars that the population over 50 will be spending over a year. This larger scope of spending is "The Longevity Economy”, i.e. the overarching economic activity stemming from longer lifespans

The common conception according to which elders are not interested in technology is plain wrong. According to the biggest retiree lobby in the US, american citizens >50 years old are adopting technology at nearly the same rate as those 18 to 49

The study also finds that older adults are highly engaged with their devices, but don’t use technology to its full potential, especially for use cases around autonomy at home. 46% of all home assistant or smart speaker owners over 50 don’t use them daily

The case for using technology to enhance wellness and health is also overlooked. 76% of adults >50 indicate wanting to age at home, and 50% are okay with a mix of technology and health care professionals helping them to do so

Gerontologist and product specialist Keren Etkin provides a comprehensive overview of use cases in AgeTech, as well as a start-up mapping:

Why is AgeTech a late blossoming ?

The AgeTech market is held back by a number of factors that make the boom of a start-up ecosystem harder:

Go-to-market is constrained. The global aging population is pauperized, including in older segments (aged 80+) of the population. In France for instance, the median pension hovers around €1,200/month. Besides, the fraction of the population best positioned to spend on new technologies and services (the “Boomer”) is increasingly pauperized

Elderly care doesn’t scale easily. Providing medical care and support for daily activities requires in-person, human-to-human care in most cases. This is why AgeTech’s emergence is late to the great dance of digital transformation

AgeTech’s end markets are a mess. The mess that the organization of aging in the Western World represents is as much an opportunity that it is a bottleneck for AgeTech companies. It’s comprised of fragmented agencies, financing systems, outdated IT infrastructure and suffers from budget constraints. All of these factors slow the pace of change but also make a compelling case for it

For most people my age (25), taking care of elder relatives is not something we would worry about everyday. Conceptualizing their needs and walking in their shoes is a difficult task.

To better grasp who could benefit from innovations in Age Tech, I tried to imagine “personas” to understand who the stakeholders are, and why they are so underserved:

The Brain Candy Grandma. She is around 80 to 90 years old, living in an assisted facility with full time aides. She’s present mentally but needs help getting around and doing mundane tasks. She’s educated and has tons of intellectual curiosity.

Pain point: She is bored, and this might increase her feelings of loneliness and isolation

Needs: As a result, she needs community, social interaction, mental stimulation

Solutions: She could engage in better group learning experiences (apps?), could benefit from better educated aides or caregivers with shared interest (better caregiver matching ?)

Examples of companies: Grandpad (Tablets, community and interaction), Ayuda Care (Community and interaction)

The Widower Grandpa. He’s around 80 years old, is independent and lives at home. He mainly gets around on his own, and only gets aided for grocery shopping and laundry 2x a week

Pain point: Despite being independent, he feels lonely is increasingly not self-sufficient as he ages

Needs: Community and social interaction, being able to afford quality in-home care, autonomy

Solution: Tech enabled care, community and social platforms, engaging content

Examples of companies: Umbrella (Home and care services), Hero (Intelligent & connected medication dispenser), Gogograndparent (Ordering Ubers & Lyfts without a smartphone)

The Retired Baby Boomers. They’re a 55 to 65 couple living in the suburbs. Their big house is their main asset, and they have experience in caring for elder parents

Pain point: Retirement is new, they’re unsure how to spend their time. As they know what aging entails, they want to limit the burden on their kids

Needs: Community activities, engaging and entertaining content, financial security and planning

Solutions: Continuing education courses, custom-made financial planning tools, tailored content

Examples of companies: Umbrella (Home and care services), Hometap (Home equity services with tailored offers for seniors), BluePrint Income (Insurance-backed income for seniors), Nesterly (Trans-generation homeshare services), Trusty.care (Administrative assistant for all things medicare)

The burdened family member. He or she is coordinating all the aides and medical staff, finances and dedicates time to their parent’s aging process while working full time and caring for their own family

Pain point: Under constant financial and mental stress

Needs: Outsourced care coordination and relief

Solutions: Orchestration solutions, clear and actionable information on end-of-life planning, emotional support

Underpaid caregiver. Works an underpaid yet important job to society, in some countries (such as the U.S.) multiple jobs to make ends meet for their own family.

Pain points: insufficient wage, poor worktime planning, poor benefits, insufficient continuous training

Needs: Better training, sense of community, better organized work schedules

Solutions: Community platforms, tech-enabled work agencies

Example of companies: Honor (Jobs, training and facilitating tools), Maven Care (Job marketplace), CareGuardian (Connected caregiving), CareSwitch (Payroll and benefits for home caregivers)

I would say there is two interesting opportunities to make a medium-term impact here:

Care coordination. Businesses have emerged to take care of the burdened family member. Products vary, from creating a marketplace for care (e.g. Trusty.care), to managing digital home health agencies (e.g. Honor), or simply acting as a coordinating tool (e.g. Wellthy). The lack of incremental spend to go direct-to-consumer inspired some of these companies to turn to employers and market their products as solutions for family caretakers to spend more time at work, and met mixed success. While the need is undeniable, go-to-market channels remain a significant challenge.

💡: Other GTM entry points for an “end of life” brand could be : estate planning (how will I manage transition from my home to assisted living facility), starting downstream in funerary services (working backwards the lifecycle to address prior needs") or upstream in work life to retirement transition solutions (starting with the needs associated with this transition then moving downstream afterwards)

Content and programming. Surprisingly, most of the white space resides in imagining a “things to do” and “things to watch” platform for the elderly and the newly retired. Although having usage challenges, the distribution playbook is well written, and scaling a content business is much easier than scaling a complex marketplace.

💡: Nice innovations in the overall experience could include delivering content in a way that generates group experiences, crafting learning material to help boomers generate supplemental income from home. Let’s just keep in mind that any content that requires group coordination will be much tougher to scale

After this attempt at breaking down the “general” needs that any elder population can face and the attached challenges for prospective companies to go to market with products to address them, I want to take a closer look at the French market and its opportunities.

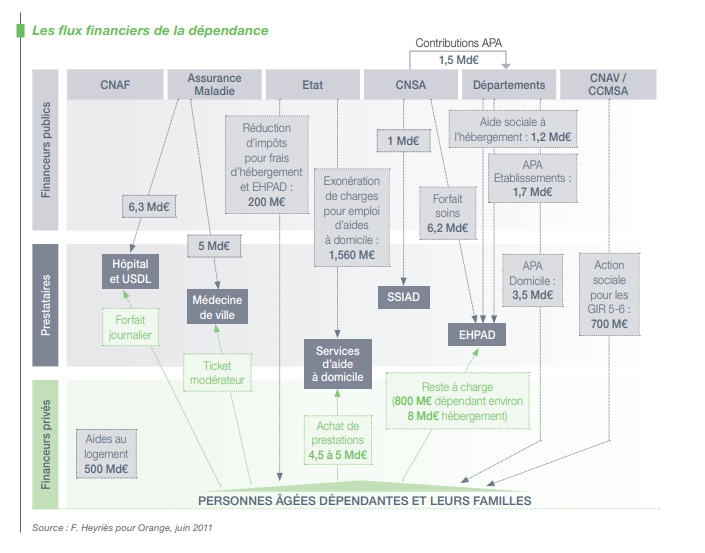

The total spending in elder care for Europe and France is a significant amount, although it’s unclear how much of it can benefit AgeTech companies:

The European elderly care market is projected to hit €130bn in public and private expenditure

The French elderly care market is projected to hit €31bn, of which only 22.5% is private expenditure

Where are we right now ?

In my opinion, the most salient characteristics of the French system are the following :

The financing structure is a hot mess. The French elder care system, although massively state-supported, has an incredibly complex financing structure. To date, there has been little attempts to facilitate and simplify financing. This infographic from 2011 sums it all up (in french):

The stakeholders operate in silos and are badly coordinated. The family caretakers are often the only ones that have comprehensively mapped out care needs. Hence, they often manually coordinate the different stakeholders, meaning they physically communicate information and patient data to medical personnel. No independently built on-shelf solution has yet tackled this issue at scale in France.

Services rely heavily on unorganized non profits. Local service offers rely heavily on smaller organisations. While being locally agile by design, they have limited investment capabilities and are extremely atomized: 8,600 different organizations employing 224k people full-time, with an additional 1.3m independent workers. Local non-profits mainly lack three things (i) process mapping and information reliability (ii) viable business models. Private organizations could help them in achieving both.

What are the opportunities ?

The need for a “pivot operator”. The role of a “pivot organization” could be imagined in a public-private partnership. Its mission would be to aggregate and organize information and services around elderly care. As illustrated by various whitepapers, the public sector has attempted to build a pivot system for elderly care cooperation with mixed success. Here is an overview at what such an “operating system” could look like :

Reframing insurance needs. Insurance needs of the elderly are vastly different depending on the age, disparity in medical conditions that people face. Insurance companies are yet to design insurance products and services focusing on preventive care and elder reliance. As evidenced by the emergence of companies like Alan, mutual care is transforming to vertically integrate and offer tailor-made services attached to insurance products. Such breakthroughs require an agility (speaking from my own experience working at a mutual insurance company) that dominant insurance companies do not have

SaaS whitespace. Caregivers and institutions rely on discontinuous, isolated systems that are prominently on-premises. Medical institutions lack efficient communication and data tracing for their personnel and patients, and on-shelf SaaS would allow two things on premise can not do as well: (i) Baked-in scalability at regional, national levels (ii) Easier interoperability : APIs, patient or family-side interfaces

Data privacy and coordination. Front-line caretakers and families lack the ability to securely trace and circulate medical information. A platform or medium enabling the secure processing, storing and sharing of all necessary care data would hugely benefit the entire system

Some French companies I’ve noticed recently :

Famyhelp. Famyhelp is an app catering to the coordination and discovery needs for family aides in search of care for elder relatives. It aggregates information on caregivers and streamlines communication for between aides and family members

Colette Club. Colette Club is a private matchmaking service connecting students and young professionals looking for affordable housing and elder people looking to rent out a room in their house or apartment. Beyond the warm landing page and site, there’s the craziness and courage of founding such a company in the midst of a global pandemic and that’s the step founder Matthieu Vaxelaire took !

Responsage. Responsage is a service and documentation system that helps employers assist their staff aiding elders or relatives. It is an interesing example of an attempt at attacking the AgeTech market from the B2B side, and getting companies to finance part of the expenditure in showing them how this affects employee productivity

Lumeen. Lumeen designs experiences to replace the use of medication in the fight against senility and associated diseases. Through VR experiences, patients and elder residents of nursing homes can enjoy relaxation, guided memorization and cognitive stimulation

Ressource list:

Livre Blanc du Bien Vieillir, Syntec Numérique, 2015

Grand Age et Numérique: Objectif 2030, Matières Grises, 2019

The Gerontotechnologist by Keren Etkin

Matières Grises, Think Tank